You have to prepare for such emergencies as you may never know when the same might strike. Rainy Days: From time to time, emergencies do arise.

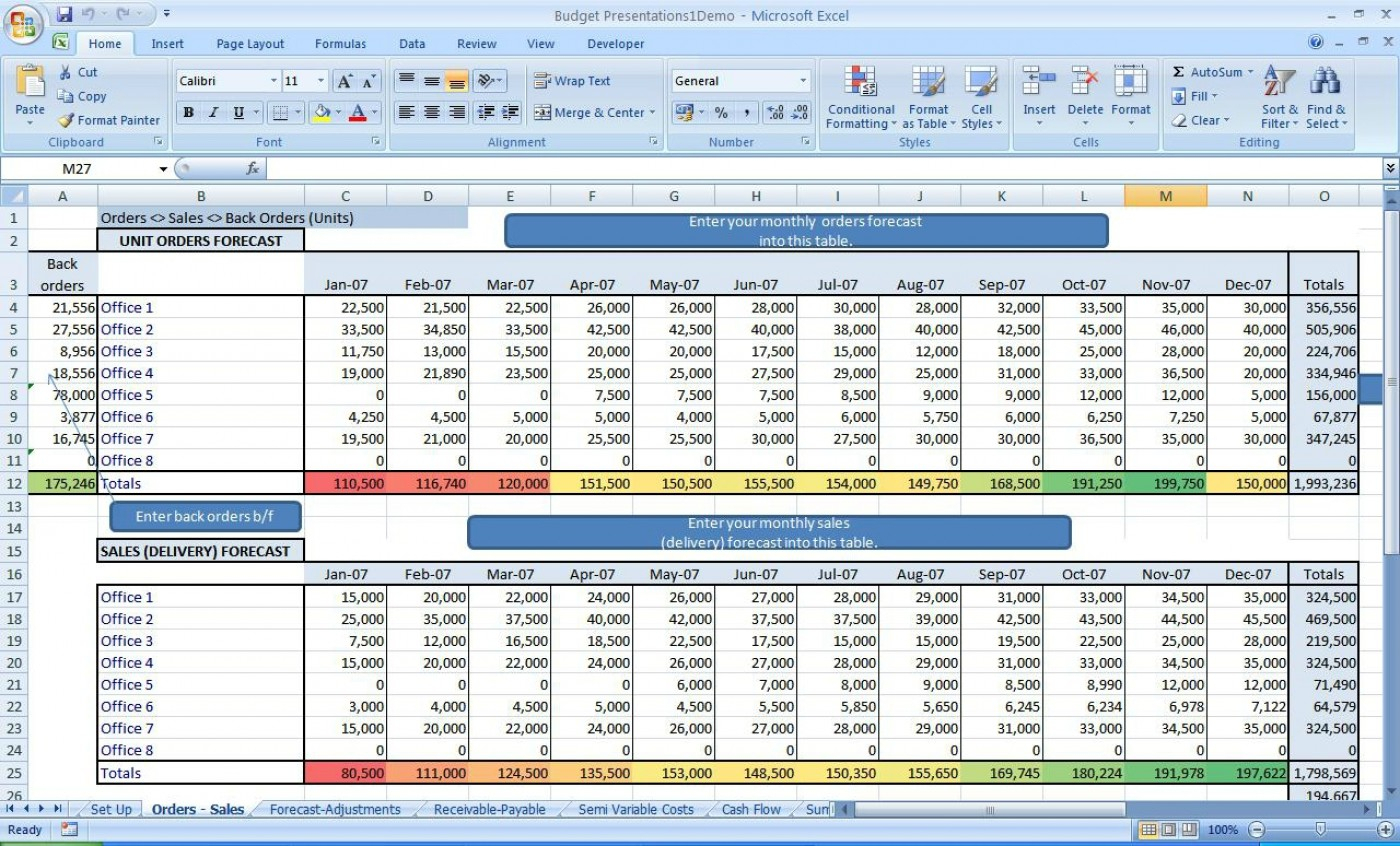

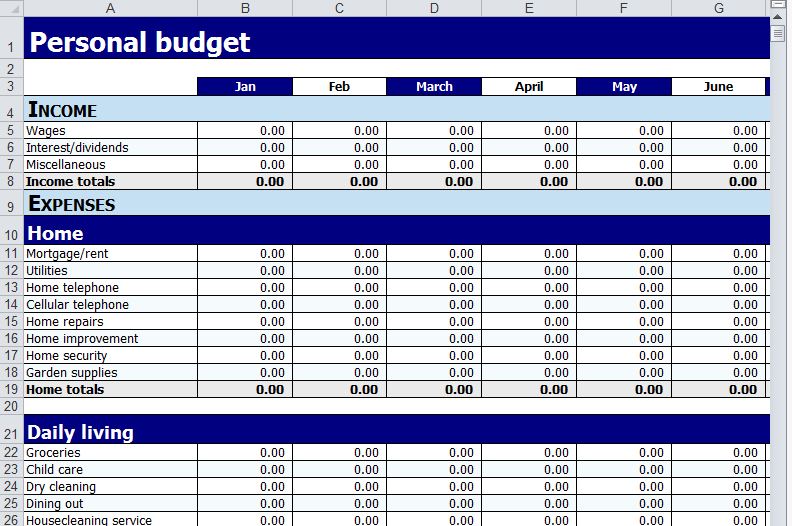

They often have the tendency to overburden you, the borrower, if not handled well. Even though banks and other lenders can give you the start-up capital, these loans come at too great a cost. Start-up Capital: Wanting to start a business? Yet again, you will have to save money for the course. These goals generally require huge capital outlay that may not be attained that easily. These could include college fees, debt repayments, and other expenses that may have to be taken care of only in the long run. Long-term Goals: You may save money for the sake of helping you to achieve your long-term goals. Below are some of the top benefits that accrue from such savings. Saving money indeed brings about many benefits. Make any adjustments if need be to rationalize your expenses accordingly. Yet again, you have to exercise a great deal of caution to prevent any errors or mishaps from springing forth. Now enter that data within the cells provided for by the worksheet. Step III: Enter the Estimates in each cycle If it is a quarterly basis, you will have to divide by 4 and so on. If you choose a monthly cycle, for instance, divide the specific annual income or expense by 12 to find out a rough monthly estimate. Next, harmonize the incomes and expenses to line up with that cycle. Step II: Harmonize your income and expenses as per that cycle Regardless of the choice you make, you have to see to it that it is comfortable for you. It could be monthly, weekly, or even yearly. This refers to the period of time within which you want your budget to be crafted. Step I: Determine your budget cycleįirst and foremost, you have to determine your budget cycle. This segment of our discussions endeavors to do just that. Some of them do happen at some periods that are beyond the normal scope or cycles. Not every income or expense you incur happens regularly. How to Care for Erratic Incomes and Expenses That may mean you are cutting down on some of the things you love most and dipping the extra in the saving pot. Savings simply entail determining your expenses in such a way as to be less than your income. Step V: Save some moneyīudgeting is perhaps the best time to consider setting aside some of your money in the forms of savings. You have to figure out just how much you are willing and able to spend and then go ahead to revise your expenditure accordingly.

Rationalizing means adjusting the expenses in such a way as they fit within the budget space of your choice or intent. Thereafter, draft a provisional subtotal to give you a rough clue of your anticipated expenditure. By assigning a cap, we mean drafting a maximum amount of money you might have to spend on that particular expense. This is now the core of the budgeting process. Be detailed and meticulous to avoid any situation where you might overlook some expenses or incomes. Create a table and go ahead to dichotomize your money in those two categories. Next, sort the money into income and expenses. Total – $1,525 Step II: Sort the income and expenses It also eliminates any form of guesswork to allow you to work with concrete facts and figures. That will give you a clear picture of just how much you are to accrue and from where the money might come. Start off by listing all the sources of your income over the period of time of interest. Below are the steps you have to go through to achieve this end: Step I: List all the sources of your income We kick off the exercise by examining the steps involved in preparing a budget.

0 kommentar(er)

0 kommentar(er)